Taxing times

Changes to the tax regime for locum lawyers threaten to disrupt the supply of a vital source of staff for local authority legal departments, writes Neasa McErlean.

Changes to the tax regime for locum lawyers threaten to disrupt the supply of a vital source of staff for local authority legal departments, writes Neasa McErlean.

Hundreds of locum lawyers are facing the prospect of 30% falls in their take-home pay as many temporary lawyers are switched from contractor to employee status following changes to tax rules in April known as IR35.

Faced with the choice between accepting pay cuts or changing career strategy, recruiters predict that many of the estimated 1,000 locum lawyers working for local authorities will vote with their feet. Local authorities, they say, will have to rethink their approach by the autumn or winter. If not, local government could face severe shortages in this part of the recruitment market.

The aim of IR35 is to prevent “disguised employees” from working on a self-employed basis and claiming the tax benefits that come from self-employment. Which working patterns should be considered as “employment” can be subjective, however, and since the rules were changed most councils have erred on the side of caution, re-classifying locum lawyers as employees rather than contractors.

Room for compromise lies, however, in the way that the IR35 legislation is being implemented. Councils to date are tending to rely on the rather limited interpretation of the law which underpins a tool that many of them are using - the IR35 calculator (www.gov.uk/guidance/check-employment-status-for-tax) produced by HM Revenue and Customs (HMRC). Chris Lee, founder of Fiscability UK and a former tax inspector, told Local Government Lawyer: “HMRC's IR35 calculator will probably give the correct answer in straightforward cases, but it can prove wrong (in either direction) and most borderline cases come up with a ‘don't know’ answer.”

Sellick Partnership is the market leader in recruiting local authority temps, placing about half of the 1,000 people that it estimates work in this role. “IR35 is, by far, the most serious issue I’ve seen in my 13 years in this sector,” says Sellick Partnership Group Director Hannah Cottam, head of the legal team in Manchester and Leeds. She gives an example of a temp earning £40 an hour who took home £34 when taxed as a contractor but who would receive £24 if paying tax and NI under IR35.

At specialist law firm HY, Director David Yazdi comes to a similar figure. HY is a modern legal practice which offers its ‘Law on Demand’ service to enable freelance working for local authorities within HMRC’s calculator assumptions. “The changes to IR35 generated a lot of interest from locums about our service. What we are hearing is that they are taking an almost 30% fall in pay,” he says. He also gives the example of one consultant who works away from home and whose hotel and travel expenses can no longer be set against tax (the standard practice for contractors which is denied to those on PAYE). “He told me that his profits a week have fallen to £300,” says Yazdi.

Layers of complexity

Deciding whether someone is an employee or an independent contractor is accepted by HMRC and all tax experts as being a complex issue which cannot be decided in all cases on a tick box basis.

In one of the defining cases, Hall v Lorimer, the Court of Appeal upheld the High Court decision of Mummery J who had said: “This is not a mechanical exercise of running through items on a check list to see whether they are present in, or absent from, a given situation. The object of the exercise is to paint a picture from the accumulation of detail.”

People affected here are those who work for a personal service company or other intermediary and who, absent the intermediary, might be classed as employees. The legislation does not affect self-employed people working without an intermediary company.

The specific background behind IR35 is explained by Lee: “HMRC have long been concerned about people working through intermediaries, such as their own limited company, and so paying reduced amounts of tax and National Insurance. IR35, introduced in 2000, was an attempt to counteract that but it has not proved particularly effective, partly because policing it is very resource intensive for HMRC. And, because any tax liability falls upon the intermediary, or the worker, many ‘employers’ have been able to safeguard their own position by insisting that workers operate through an intermediary.”

What changed in April was that public sector employers were made liable for the extra tax and NI payable by teachers, doctors, nurses, lawyers and others in the contractor arrangement who went on to be deemed employees in disguise by HMRC.

Lee adds: “Many organisations seem likely to take a safety first approach and deduct tax that may not be properly due, so unfairly penalising the worker.”

Policy shaping

In many councils, personnel in Human Resources and Finance - rather than legal teams - have been shaping policy on IR35. How is that being implemented?

Two authorities have given detailed descriptions. A Bristol City Council spokeswoman told us: “We are taking a cautious approach with IR35 after carefully considering HMRC guidance and looking at the nature of the work interims are doing.

“Most interims are covered by the new legislation and challenges to this position were only accepted in a very small number of circumstances so far. Our carefully considered opinion is that to do otherwise would create the type of ‘disguised employment’ that the revised legislation is seeking to eliminate.” Regarding the possibility of exceptions, she added: “Individuals deemed affected by the revised IR35 legislation were invited to submit a challenge to this decision. These challenges are assessed in line with information provided by HMRC and our independent tax advisors.”

At Medway Council, a spokeswoman said: “All self-employed consultants have been assessed using the criteria set by the HMRC tool to see if they fall in or out of scope of IR35. Those that fall within scope are being treated as employees and being paid via payroll with PAYE and NI contributions taken at source. There are no exceptions.”

Asked how Medway would respond to a ‘don’t know’ or ‘undecided’ response from the IR35 calculator, the spokeswoman added: “We have not yet been faced with that scenario, but our default position is that unless otherwise demonstrated self-employed contractors are considered ‘in-scope’.”

For its part, HMRC told Local Government Lawyer: “‘The [IR35 calculator] Employment Status Service has been extensively tested with the largest public bodies and stakeholders affected by the changes. While we will not oblige customers to use the service, HMRC will stand by its results where correct information has been inputted in line with the guidance…. If there is a disagreement on the facts, the contractor should first try to resolve it with the engager. If they cannot agree, the contractor has the option of making a claim for overpaid tax through their Self Assessment tax return. If HMRC disagrees the claim, the parties can test the matter before the tax Tribunal.”

Market turbulence

So what will happen now? “Like most new changes in law, there can be a time lag before it is properly understood and applied,” says Azhar Ghose, an independent consultant who has been researching, advising and writing on IR35. “For IR35, it requires a distinction to be made between the status of a worker as an employee versus a worker who is operating as a business. At present, not enough attention is being paid to the contractor’s business model to come to a proper determination of the workers status. More questions need to be asked.” Cottam says: “The local authorities need more education. They won’t change unless there is more information made available.”

“Local authorities will be pushed into looking at alternative options,” says Yazdi. “We estimate that the true impact of IR35 will be felt in the next three to six months. You could foresee skills shortages in councils - especially in planning, adult social care and commercial.”

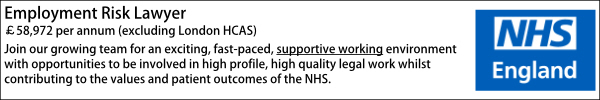

Many local authorities depend on temps for some areas of legal work - not least because it can be all but impossible to recruit permanent staff at current pay salary levels. Could tariffs for temps rise in order to make it viable to work as employees? “Locums are really critical in local government,” says Cottam. “We expected rates to go up but that has not happened yet.” She is finding, however, that “the more senior the contractor, the more likely the local authority is to look at the issue laterally”.

HY Legal is expecting locums to leave the sector rather than lose pay. “Many have advised they were looking at jobs in-house or in the private sector,” says Yazdi. Cottam is also seeing “a lot more people taking on a permanent role”. She suggests one sticking plaster solution: “We will have to backfill with less experienced, less expensive people.”

There is no question that some people have been ‘pretending’ to be independent contractors under the new rules but are far closer to employee status - in particular those working for over a year in the same role and from the premises of a local council. But there are others who are genuinely independent - often working from home, deciding their own hours and advising a number of organisations.

Elsewhere in the public sector

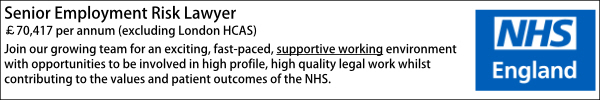

If local authorities do decide they want to take a more nuanced (and possibly fairer) approach, they can look to what is happening in other parts of the public sector. NHS Improvement (the body responsible for overseeing foundation trusts and NHS trusts) had to withdraw its previous guidance in May saying that “all locum, agency and bank staff were subject to PAYE and [should be] on payroll”.

A Royal College of Nursing (RCN) spokesman told Local Government Lawyer: “It’s clear this [previous guidance] was an ill-judged move that seems to have been rushed through with insufficient consultation and little thought to the impact it would have on staff.” The blanket approach had “sparked widespread problems across the health service…as agency staff turned down shifts or failed to turn up for work”, according to the RCN.

In its volte-face, NHS Improvement stated that its previous guidance “was not accurate”. It now says that determinations must be done on a “case-by-case basis”. It adds that each “consideration must be conducted fairly, accurately and take into account all relevant factors, including representations which may be provided by the individual”.

Regarding HMRC’s calculator, it says: “This tool does not negate the necessity for careful case-by-case scrutiny.” Organisations acting for consultants are hoping that the public sector will become more sceptical about HMRC’s calculator. And, even if legal departments do not have great experience of tax, they will be familiar with the broader arguments. Julia Kermode, chief executive of the Freelancer & Contractor Services Association, told Local Government Lawyer: “Creating a tool that is distinct from case law is unfair and will lead to some being incorrectly deemed as caught by IR35, and will, therefore, result in these people challenging the tool’s outcome.”

Meanwhile, Dave Chaplin, CEO of ContractorCalculator (a portal for freelancers) said: “The HMRC tool only asks a maximum of 16 questions. You simply cannot capture the nuances of every IR35 case in that many. We tried, but ended up with 101.”

In deciding to be cautious on IR35, local authorities are aiming to reduce the risk that they are exposed to over picking up the tax and NI bills of people who are not genuinely working independently. But councils are usually also taking on the extra cost of paying employer’s NI at the standard rate of 13.8%.

Had the private sector also been brought into the new IR35 net, then local government could have ridden on the back of companies which are used to challenging HMRC and which would have viewed the IR35 calculator in a less reverential way. The government aims to extend the new IR35 legislation to cover the private sector at some stage. But we do not know when that will happen.

In the meantime, local authorities may need to take a more circumspect stance if they want to continue accessing the short-term recruitment market in the way they do today.

Neasa McErlean is a freelance journalist

This article was first published in the July edition of Local Government Lawyer Insight, which can be accessed at http://www.localgovernmentlawyer.co.uk/insight Insight is published four times a year and is circulated free-of-charge to all Local Government Lawyer newsletter subscribers (click here to subscribe) in electronic format. A single hard copy is also circulated to all local authority legal departments in England and Wales. Additional printed copies are available for just £49.95 for four issues. Multiple copies are also available at £149.95 for five or £249.95 for 10. Payment can be made by purchase order/invoice or by credit/debit card. To order, please call 0207 239 4917 or email This email address is being protected from spambots. You need JavaScript enabled to view it.. |